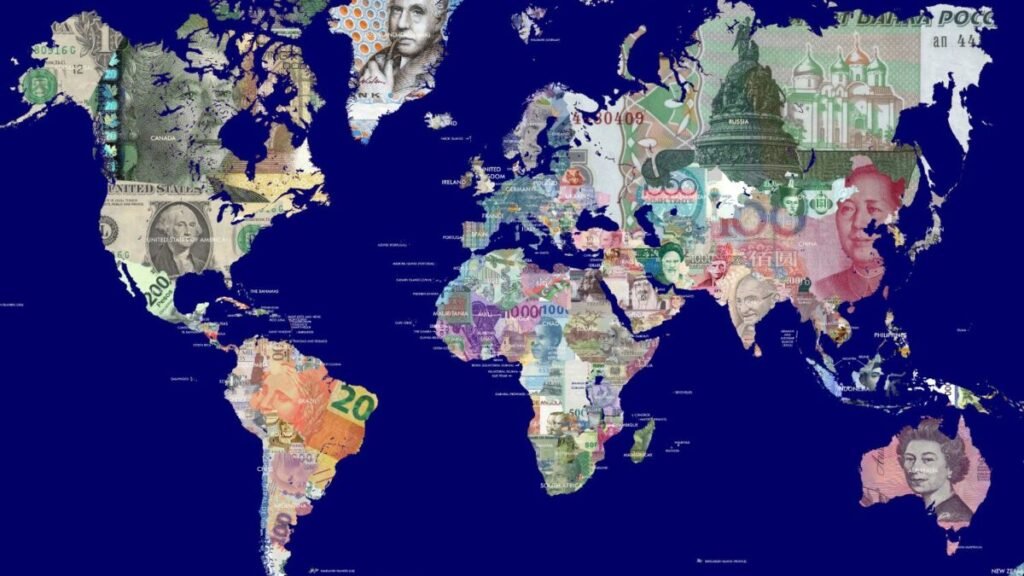

“Which Countries are Drowning in Debt Right Now? Let’s Talk Risks and Problems!”

Debt-to-GDP ratio is crucial to understand a nation’s fiscal health. A high level can indicate structural issues, limited capacity to fund services, and vulnerability to financial shocks. Recent data shows countries with the highest debt-to-GDP ratios are facing internal crises. Sudan leads with a ratio close to 252%, a consequence of conflicts and lack of access to financial markets. Japan follows with around 235-250%, a result of decades of stimulus policies. Then, Singapore (175%), Italy (135%), and Argentina (155%) follow.

### Structures and causes of indebtedness

Debt can grow for various reasons:

– **Economic stimuli and bailouts:** Japan activated financial stimuli and massive bond purchases after decades of stagnation.

– **Aging populations and increased social spending:** Developed countries like Japan and Italy face growing fiscal pressure due to older populations and pension programs.

– **Internal crises:** Sudan lost oil revenues after South Sudan’s independence in 2011, leading to external debt reliance.

– **Populist policies and expansive spending:** Brazil’s debt-to-GDP ratio rises to 82% in 2026 due to social spending and high interest rates.

– **Strategic financial debt:** Singapore issues debt not to cover deficits but to feed sovereign funds and deepen the financial market.

In internal crisis, Sudan lost oil revenues after South Sudan’s independence in 2011, forcing it to resort to external debt.

With populist policies and expansive spending, Brazil sees its ratio rise to 82% of GDP in 2026 due to social spending and high interest rates.

Strategic financial debt: Singapore issues debt not to cover deficits, but to nurture its sovereign funds and deepen the financial market.

The consequences vary: while Japan’s internal debt is manageable, Sudan’s external debt exposes it to default risk and humanitarian crises. Sustainability depends on balancing growth, inflation, and fiscal revenues.

### Latin America: Debt, Challenges, and Future

In Latin America, the debt outlook is complex. The region maintains a total debt equivalent to 117% of its GDP, of which over 70% is public. Countries like Argentina, Brazil, Bolivia, and El Salvador exceed levels considered sustainable (between 44% and 80%).

#### Argentina

With a public debt exceeding 100% of GDP in 2025, Argentina deals with payments of around US$14,000 million annually just for interests. High inflation and capital flight further complicate its position.

#### Brazil

The debt ratio is expected to reach 82% in 2026, up from 71.7% in 2022. This is due to the high Selic interest rate (15%) and increased spending under Lula’s government. The high debt service ratio limits future public investment capacity.

#### Colombia and Others

In Colombia, this ratio hovers around 66-68%, after a peak during the pandemic. While lower than Argentina or Brazil, it implies fiscal constraints and vulnerability to external shocks.

Latin America as a whole faces certain challenges:

High interest rates increase the cost of debt service. Persistent fiscal deficits reduce space for investment. Vulnerability to changes in capital flows, exchange rates, and inflation pressures. Without structural reforms and fiscal consolidation, these economies could face: lower growth, increasing tax burden, and exposure to refinancing crises.

## Global Perspectives and Consequences

On a global scale, debt has risen following COVID-19, geopolitical conflicts, and stimulus efforts. The IMF warns that combined public debt could reach 100% of the global GDP by 2027, a record high.

### Future Risks

– Debt service pressure: higher interest rates increase annual payments, consuming budget.

– Limitation of expansive policies: the room for new stimuli or public investment is reduced.

– Vulnerability to shocks: emerging economies face capital flight, devaluations, and increased risk premiums.

– Macroeconomic instability: debt crises can trigger recessions, unemployment, and social unrest.

**Macroeconomic instability**: debt crises can trigger recessions, unemployment, and social discontent.

### Opportunities

– Investing in sustainable growth can increase income and relieve the burden.

– Orderly fiscal consolidation, combined with structural reforms, can restore investor confidence.

– Public debt, if allocated to productive projects, can be a driver of development.

In conclusion, the most indebted countries—Sudan, Japan, Italy, Argentina, or Brazil—share different contexts: from humanitarian crises to aging and financial strategies. Latin America stands out in the global equation, with high levels of public and private debt and persistent pressures. The future will depend on the nations’ ability to balance spending, growth, and investment, and ultimately restore fiscal sustainability.

[Source: ]